The housing market continues to signal that a broad rebound is underway. In October, despite sparse home inventory, the number of properties sold increased 1.4% nationwide.

The housing market continues to signal that a broad rebound is underway. In October, despite sparse home inventory, the number of properties sold increased 1.4% nationwide.

According to data from the National Association of REALTORS®, on a seasonally-adjusted, annualized basis, October Existing Home Sales gained 70,000 units as compared to September, registering 4.97 million existing homes sold overall.

An “existing home” is a home that has been previously occupied and, as compared to prior months, the stock of homes for sale is depleted.

Just 3.3 million homes were listed for sale last month. This represents a 2 percent drop from September and marks the sparsest home resale inventory of 2011.

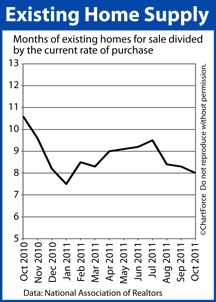

The current home supply would last 8.0 months at today’s sales pace — the fastest rate since January 2010.

The real estate trade group’s report contained other noteworthy statistics, too :

- 34 percent of all sales were made to first-time buyers

- 29 percent of all sales were made with cash

- 28 percent of all sales were for foreclosed homes, or short sales

It also said that one-third of transactions “failed” as a result of homes not appraising for the purchase price; failure to achieve a mortgage approval; and, insurmountable home inspection issues.

This 33% failure rate is huge as compared to September 2011 (18%) and October 2010 (8%). It underscores the importance of getting pre-qualified to purchase, and of selecting a home “in good condition”.

For today’s St Paul home buyer, October’s Existing Home Sales may be a “buy signal”. Supplies are falling and sales are increasing. Elementary economics says home prices should begin rising, if they haven’t already.

Remember : The data we’re seeing is already 30 days old. Today’s market may be markedly improved already.

The good news is that mortgage rates remain low. Freddie Mac reports that the average 30-year fixed rate mortgage rate is 4.000% with 0.7 discount points, making homes as affordable as they’ve been in history.

With rising home values, you may end up paying more to purchase your new home, but at least you’ll pay less to finance it.

After a brief return to lower, pre-2009 levels,

After a brief return to lower, pre-2009 levels,