With Halloween behind us, retailers are in the Holiday Spirit. Businesses know that consumers spent a median $556 on holiday gifts last year and they want this year to be just as strong.

With Halloween behind us, retailers are in the Holiday Spirit. Businesses know that consumers spent a median $556 on holiday gifts last year and they want this year to be just as strong.

That’s why it’s barely November and, already, Black Friday ads clog our mailboxes and the airwaves. Retailers want our dollars and they’re offering great deals to early shoppers.

There’s one discount a smart shopper should think twice, however — the ever-present “Open A Charge Card Today And Save 15%” promotion. In the short-term, deals like this will save money.

Over the long-term, however, opening a charge card could cost you much, much more — especially if you plan to refinance your home or buy a new one.

Applying for a charge card can lower your credit score up to 85 points.

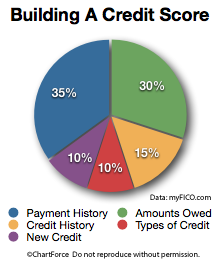

According to the myFICO.com website, as a category, “New Credit” accounts for 10% of your 850 possible credit points, comprising the following credit traits :

- Your number of recently opened accounts

- Your number of recent credit inquiries

- Time elapsed since your recent credit inquiries

- Your proportion of new accounts to all accounts

Each trait is a negative in the FICO-scoring credit algorithm which means that, with each in-store charge card application, your credit score is likely to fall. How far your score will fall depends on the rest of your credit profile.

Meanwhile, low FICO scores correlate to higher loan fees.

Using a real-life example, assuming 20% equity in a home, for either purchase or refinance, look how loan fees for a $200,000 conforming mortgage change by FICO score :

- 740 FICO : There will be no added loan costs

- 720 FICO : You’ll have a 0.250% increase in loan costs, or $500

- 700 FICO : You’ll have a 0.750% increase in loan costs, or $1,500

- 680 FICO : You’ll have a 1.500% increase in loan costs, or $3,000

- 660 FICO : You’ll have a 2.500% increase in loan costs, or $5,000

You can see first-hand how expensive low credit score can be — much more costly than the 15% saved at the mall. That’s why people planning to refinance to today’s low rates and soon-to-be Minneapolis homeowners, shouldn’t rush to save 15% at the register.

For people in want of a mortgage, high FICO scores are worth protecting.

A home appraisal is an independent opinion of your home’s value, performed by a licensed home appraiser. Appraisals are part of the traditional home purchase process, and lenders require them for most refinances, too.

A home appraisal is an independent opinion of your home’s value, performed by a licensed home appraiser. Appraisals are part of the traditional home purchase process, and lenders require them for most refinances, too. An estimated 356,000 in-home fires caused more than $7 billion in U.S. residential property damage in 2009, according to data from the

An estimated 356,000 in-home fires caused more than $7 billion in U.S. residential property damage in 2009, according to data from the