For Mendota Heights Foreclosures. See Cost Vs Value report for your projects Cost vs Value Projects

Despite 18% Contract Failure Rate, Home Resales Stay Strong

Despite fewer homes for sale nationwide, the number of home resales remains steady.

According to data from the National Association of REALTORS®, on a seasonally-adjusted, annualized basis, September’s Existing Home Sales eased by 150,000 units, falling to 4.91 million units nationwide.

An “existing home” is a home that’s been previously occupied and, despite last month’s drop, September’s sales volume remains the second-highest on record since April 2011.

This statistic is noteworthy for two reasons :

- There are 9.9% fewer homes available for sale as compared to 12 months ago

- Contract “failures” are twice as high as compared to September 2010, now averaging 18 percent nationwide

A contract failure is typically the result of homes not appraising for the purchase price; mortgage denials in the underwriting process; and, insurmountable home inspection issues.

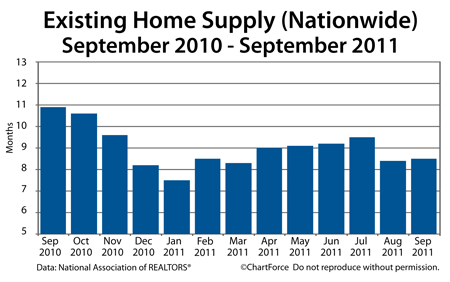

Because sales volume is steady, we can infer that more buyers are “in the market” than the final sales tallies would have us believe. This notion is also evident in the Existing Home Supply data.

In September, the number of homes for sale fell by 69,000 nationwide. At the current pace of sales, it would take 8.5 months to “sell out” the complete national inventory. This is more than 2 months faster as compared to September 2010 — a major improvement for the housing market and a sign that home prices should rise soon.

Today’s Minneapolis market exemplifies Supply and Demand. Demand for homes is holding steady as home inventories fall. This creates pressure for home buyers to make offers, and multiple bidding situations become more common. Negotiation leverage shifts to the sellers and the result is that buyers pay higher prices for homes.

Thankfully, mortgage rates remain low.

Freddie Mac reports that the 30-year fixed rate mortgage ticked lower this week, averaging 4.11% nationwide with 0.8 discount points. This means that mortgage payments are lower by $46 per $100,000 borrowed as compared to the high-point of the year.

You may pay more for a new home, in other words, but you’ll pay a lot less to finance it.

Finding Truth In September’s Housing Starts Report

Headlines in newspapers can be misleading — especially with respect to housing figures. Media coverage of the most recent Housing Starts data serves as an excellent illustration.

Headlines in newspapers can be misleading — especially with respect to housing figures. Media coverage of the most recent Housing Starts data serves as an excellent illustration.

Wednesday, the Census Bureau released its September Housing Starts report. In it, the government said that national Housing Starts rose 15 percent in September as compared to August 2011, tallying 658,000 units on a seasonally-adjusted annualized basis.

The September reading is the highest monthly reading since April 2010, the last month of last year’s home buyer tax credit.

The sudden surge in starts is big news for a housing market that has struggled of late, and the press was eager to carry the story. Here is a sampling of some headlines:

- U.S. Housing Starts Rise 15%, Hit 17-Month High (MarketWatch)

- Home Building Jumps 15% in September (ABC)

- New Construction Surges In September (LA Times)

These headlines are each accurate. However, they’re also misleading.

Yes, Housing Starts did surge in September, but if we remove the “5 or more units” grouping from the Census Bureau data — the catgory that includes apartment buildings and condominium structures — we’re left with Single-Family Housing Starts and Single-Family Housing Starts rose just 1.7 percent last month.

That’s a good number, but hardly a great one. And for home buyers and sellers throughout St Paul and nationwide, it’s the Single-Family Housing Starts that matter most. Individuals like you and I don’t buy entire apartment buildings. Most often, we buy single-family homes. Therefore, that’s the data for which we should watch.

The good news is that media tales work in both directions.

Building Permits dropped 5 percent last month when the volatile 5-unit-or-more-units category was included from the math. Isolating for single-family homes, we find that permits were unchanged.

This is good housing because 82% of homes begin construction within 60 days of permit-issuance, hinting at a steady, late-fall housing market.