Find Coon Rapids Foreclosures and no registration. For Cost vs Value project data Remodeling Cost vs Value.

Minnesota HUD Homes for Home Buyer’s, Investors, and Non-Profits!

Minnesota HUD Homes

For the Minnesota homebuyer, investor, or non-profit HUD homes are a great option. A HUD home is a one-to-four unit residential property acquired by HUD through the result of a foreclosure on an FHA-insured mortgage. HUD has released their listing site called HUDHomeStore (http:www.HUDHomeStore.com). HUD’s entire inventory is listed for the public, brokers, state and local governments, and nonprofit organizations for a centralized location of information. HUD currently has the highest number of inventory of all REO properties. REO properties are real estate owned properties by banks, lenders, or government agencies.

Currently HUD homes are offered exclusively to owner occupants for the first 30 days of the listing period for insured and insured with escrow properties. For insurability information of a specific property, please see the property info tab on HUDHomeStore. An owner occupant is defined as someone who will be using the home as their primary residence for at least 12 months. After the first 30 days, investors are then able to place bids.

HUD homes also make great investment opportunities. Minnesota HUD home investor, look no further! Inventory is changing on a daily basis; there is an average of 270+ properties on the market today. Many HUD properties are considered good “deals.” Being an investor can put money in your pocket by flipping the home or placing a renter in the property.

Buyers do not have to be low-income or first-time homebuyers to purchase a HUD home. Almost anyone can purchase a HUD home. If you have funds available or can qualify for financing, you may purchase a HUD home.

To the Minnesota homebuyer HUD homes and Minnesota HUD home investor, whether you are looking to occupy the home or are looking for an investment opportunity, a HUD home may be just right for you. Check out http://www.HUDHomeStore.com to see currently listed inventory. For more homes and properties see Minnesota Real Estate Today

Strong Job Growth In July Trumped By Credit Downgrade

More Americans are getting back to work.

More Americans are getting back to work.

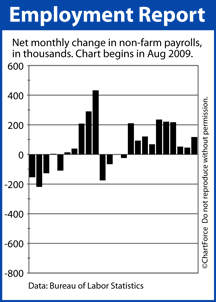

The latest Non-Farm Payrolls survey from the Bureau of Labor Statistics shows that 117,000 net new jobs were created in July, thumping analyst estimates and surprising Wall Street investors.

In addition, May and June’s originally-reported figures were both revised higher:

- May 2011 was revised higher by 28,000 jobs

- June 2011 was revised higher by 28,000 jobs

The national Unemployment Rate slipped to 9.1 percent.

The jobs report’s strong readings would typically be a boon to stock market and a threat to mortgage rates. This is because more employed Americans means more disposable income spent on products and services; and more taxes paid to governments at the federal, state and local level.

This combination fuels consumer spending and supports new job growth, a self-reinforcing cycle that spurs economic growth and often to draw investors into equities.

This month, however, the market reaction has been decidedly different.

Since the Friday release of the July Non-Farm Payrolls report, the Dow Jones Industrial Average has lost close to 6 percent of its value. Furthermore, mortgage bonds — which typically sink on a strong jobs figure — have thrived.

High demand for mortgage-backed bonds have pushed mortgage rates below their all-time lows set last November; the biggest cause of which is Standard & Poor’s credit downgrade of U.S. government-issued debt.

Ironically, the credit rating downgrade sparked a surge of safe haven bidding that has been tremendous to rate shoppers and home buyers in St Paul and nationwide. Bond buyers are flocking to the U.S.

If you’ve been shopping for a mortgage, therefore, or recently bought a home, use this week’s action to your advantage. Call your lender and ask about rates. You may be surprised at what you find.