Foreclosure rates are falling.

According to foreclosure-tracking firm RealtyTrac, monthly foreclosure filings fell 2 percent in May to just under 215,000 filings nationwide. A foreclosure filing is defined as any one of the following: a default notice, a scheduled auction, or a bank repossession.

On an annual basis, foreclosure counts have dropped over 16 consecutive months, dating back to January 2010.

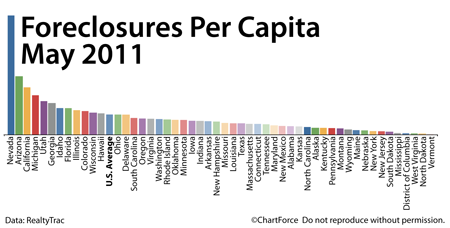

Like all things in real estate, though, foreclosures are local. 6 states accounted for more than half of the country’s foreclosure filings in May. Those six states — California, Michigan, Arizona, Florida, Georgia and Texas — represent just 34% of the U.S. population.

But even on a per household basis, the figures remain disproportionate.

- Top 10 Foreclosure States : 1 foreclosure per 357 households, on average

- Bottom 10 Foreclosure States : 1 foreclosure per 8,764 households, on average

The nationwide foreclosure rate was 1 foreclosure per 605 households.

As a home buyer in St Paul , foreclosures matter. Distressed homes account for close to 40% of home resales and that’s because distressed properties often sell at steep discounts; in some markets, up to 20 percent less than a comparable, non-distressed home. Foreclosed homes can be a great “deal”, therefore, but only if you’ve done your homework.

Buying a bank-repossessed home is different from buying from “people”. The contracts and negotiation process are different, and homes are sometimes sold with defects.

If you plan to purchase a Minnesota foreclosure, therefore, speak with a real estate professional first. With foreclosures, there’s a lot you can learn online, but when it comes time to submit an actual bid, you’ll want an experienced agent on your side.

The jobs market is recovering slower than expected, and so is housing. But neither condition has slowed U.S. consumers.

The jobs market is recovering slower than expected, and so is housing. But neither condition has slowed U.S. consumers.