Home affordability moved higher last quarter, buoyed by stable mortgage rates and falling home prices in Minnesota and nationwide. The National Association of Home Builders reports that Q1 2011 Home Opportunity Index reached an all-time high for the second straight quarter last quarter.

Nearly 3 of 4 homes sold between January-March 2011 were affordable to households earning the national median income of $64,400. It’s the 9th straight quarter in which home affordability surpassed 70 percent, and the highest reading in more than 20 years of record-keeping.

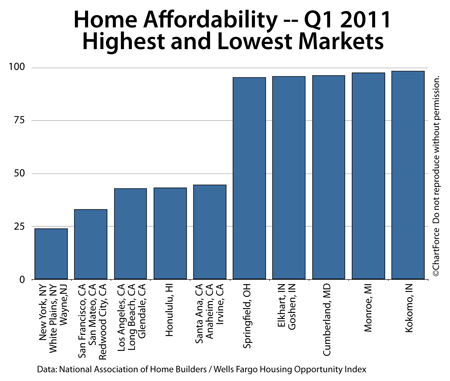

From metropolitan area-to-metropolitan area, though, affordability varied.

In the Midwest, for example, affordability was high. 7 of the 10 most affordable markets were in the Midwest, including Kokomo, Indiana, in which 98.6% of homes were affordable to median income-earning families. Indianapolis, Indiana placed second for “big city” affordability.

The most affordable “big city” last quarter was Syracuse, New York. With a 94.5% affordability rate, Syracuse ranks 8th nationally in the Home Opportunity Index. It’s the second time that Syracuse placed first in the last 4 quarters.

Meanwhile, on the opposite end of home affordability, the “Least Affordable Major City” title went to the New York-White Plains, NY-Wayne, NJ area for the 12th consecutive quarter. Just 24.1 percent of homes were affordable to households earning the area median income, down more than 1 percent from the last reading.

Regardless of where you live, remember that rising mortgage rates can levy more pain on your household budget than can rising home values. And mortgage rates are expected to rise long before home prices do.

The rankings for all 225 metro areas are available for download on the NAHB website.

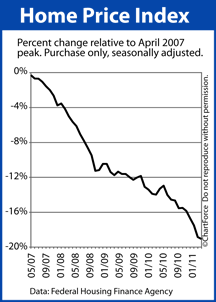

Home values dropped for the sixth straight month in March 2011, according to the Federal Home Finance Agency’s

Home values dropped for the sixth straight month in March 2011, according to the Federal Home Finance Agency’s