With large swaths of the country bracing for an historic Mississippi River flood, it’s important to remember that floods aren’t just regional.

With large swaths of the country bracing for an historic Mississippi River flood, it’s important to remember that floods aren’t just regional.

Flood waters can strike any city, in any state, at any time. According to FloodSmart.gov, floods are the #1 most common disaster in the United States. $709 million in flood insurance claims were paid to households, businesses, and renters in 2010 — more than one-third of which went to people outside of “high-risk areas”.

Should a flood hit your home or place of business, will you know what to do? The first 24 hours are crucial.

First, make sure that your home is safe from danger. Floods can damage a home’s structural integrity, creating cracks and gaps in its foundation, among other problems. If you see any such damage, your home may be unsafe for re-entry.

Next, check for exposed power lines and damaged gas and sewer pipes. Notify your local utility company and be prepared to wait for a service representative. During times of natural disaster, utility companies receive a lot of inbound phone calls.

A good follow-up is to disconnect your home’s power at its circuit breaker. This way, electricity can’t mix with water in your home by accident — a potentially lethal combination.

Once your home is safe, use a camera to document damage. Note: Do this before you start removing water or making repairs because it’s evidence for the insurers.

You’ll also want to throw out food and other items that have come into contact with flood waters. Flood waters may contain raw sewage and other contaminants that can harm you.

Lastly, contact your insurer and explain your situation. Be sure to follow your insurer’s exact instructions because you don’t want to do something that will void your claim. If you plan to make an immediate repair, notify your agent. Document your conversation with date, time, and topics discussed.

Like utility companies, your insurer may be overwhelmed with phone calls during a local flood. Optionally, you may call your insurer’s headquarters instead.

Just one inch of water can cause serious damage to your home. When flood waters hit, know what to do.

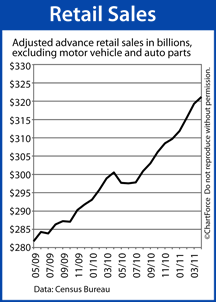

Another day, another piece of evidence that the U.S. economy is expanding.

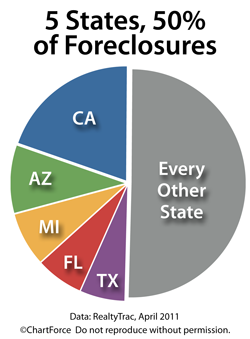

Another day, another piece of evidence that the U.S. economy is expanding. Foreclosure activity continues to drop nationwide.

Foreclosure activity continues to drop nationwide.