If you’re thinking of buying or selling a home, chances are you’re focusing on the many extraordinary ways it’ll change your life. But do you know it has a large impact on your community too?

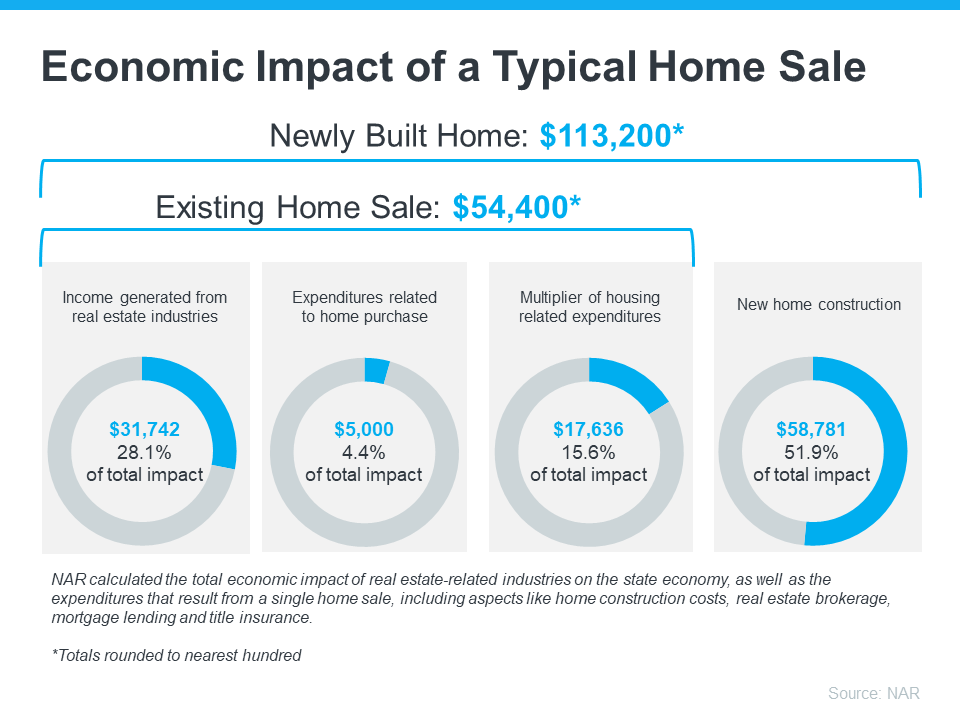

To measure that impact, the National Association of Realtors (NAR) releases a report each year to highlight just how much economic activity a home sale generates. The chart below shows how the sale of both a newly built home and an existing home impact the economy:

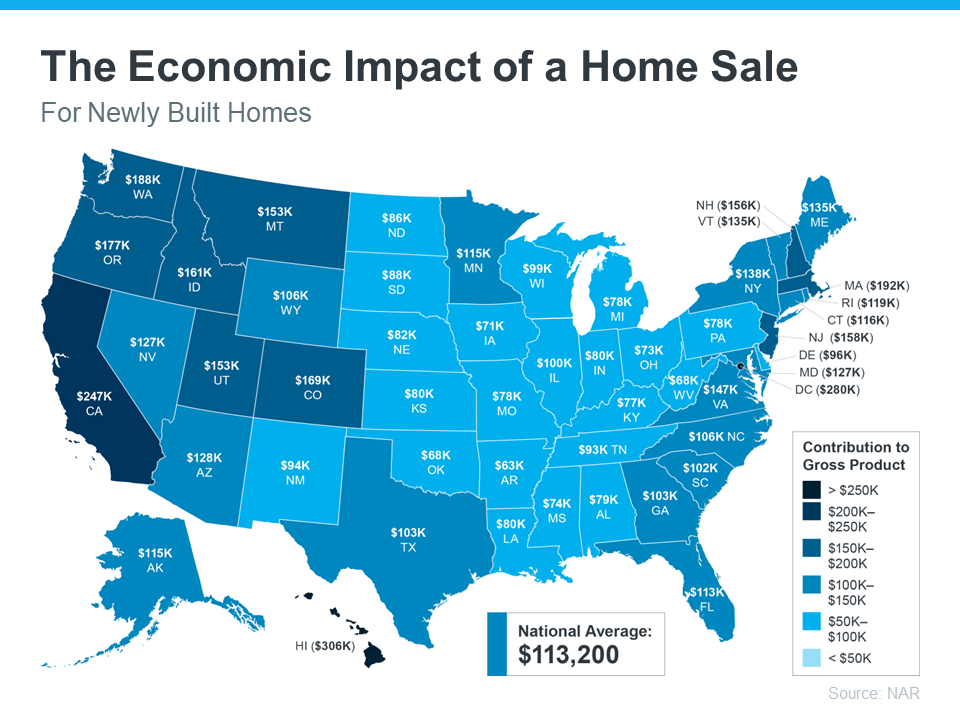

As the visual shows, a single home sale can have a significant effect on the overall economy. To dive a level deeper, NAR also provides a detailed look at how that varies state-by-state for newly built homes (see map below):

You may be wondering: how can a single home sale have such a major effect on the economy?

For starters, there are multiple industries that play a role in the process. Numerous contractors, specialists, lawyers, town and city officials, and so many other professionals are all necessary at various stages during the transaction. Every individual you work with, like your trusted real estate advisor, has a team of professionals involved behind the scenes.

That means when you buy or sell a home, you’re leaving a lasting impression on the community at large. Let the knowledge that you’re contributing to those around you while also meeting your own needs help you feel even more empowered when you decide to make your move this year.

Bottom Line

Homebuyers and sellers are economic drivers in their community and beyond. Let’s connect so you have a trusted real estate advisor on your side if you’re ready to get started. It won’t just change your life; it’ll make a powerful impact on your entire community.

One of the most significant challenges that many people face when preparing to buy a first home relates to saving money for a down payment. While there are many different loan programs with varying down payment requirements, the fact is that it can still be difficult to save up a large sum of money. Some programs may require you to save as much as 10 percent or 20 percent of the sales price of the home.

One of the most significant challenges that many people face when preparing to buy a first home relates to saving money for a down payment. While there are many different loan programs with varying down payment requirements, the fact is that it can still be difficult to save up a large sum of money. Some programs may require you to save as much as 10 percent or 20 percent of the sales price of the home.