Do You Know How Much Equity You Have in Your Home? [INFOGRAPHIC]

![Do You Know How Much Equity You Have in Your Home? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/04/05162315/20220408-MEM-1046x2334.png)

Some Highlights

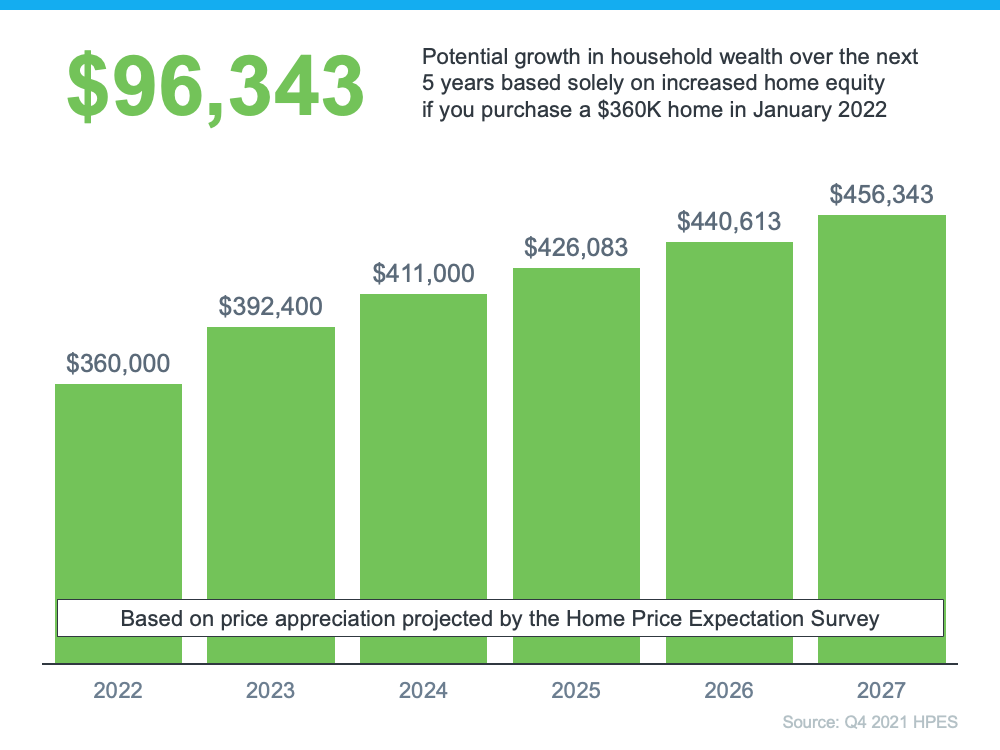

- If you’re a homeowner, your net worth has gotten a big boost. That’s because recent home price appreciation has increased your equity.

- Your equity grows as you pay down your loan and as your home increases in value. Over the past year, the average homeowner’s equity grew by $55,300.

- Ready to sell? Let’s connect to talk about how you can use that equity to fuel your next move.

Purchasing a house is expensive. Not everyone has the money to put down 20 percent. One of the ways to make it easier to afford a house is to live in a home with multiple generations. Some people decide to move back in with their parents because they might have a difficult time affording a mortgage and student loans. Some parents move in with their children because they have health-related issues that need to be addressed. Now, multi-generational homes are becoming more common.

Purchasing a house is expensive. Not everyone has the money to put down 20 percent. One of the ways to make it easier to afford a house is to live in a home with multiple generations. Some people decide to move back in with their parents because they might have a difficult time affording a mortgage and student loans. Some parents move in with their children because they have health-related issues that need to be addressed. Now, multi-generational homes are becoming more common.