Every year, many renters ask themselves the same question: Should I continue renting, or is it time to buy a home? If you’re a renter, chances are you’ve asked yourself that question at least once, and it’s likely because you’ve faced an increase in your monthly housing costs over time. After all, according to Census data, rents have risen consistently for decades.

To make an informed and powerful decision, the first step is understanding what’s happening in today’s housing market so you can determine which option is the better long-term financial decision for you.

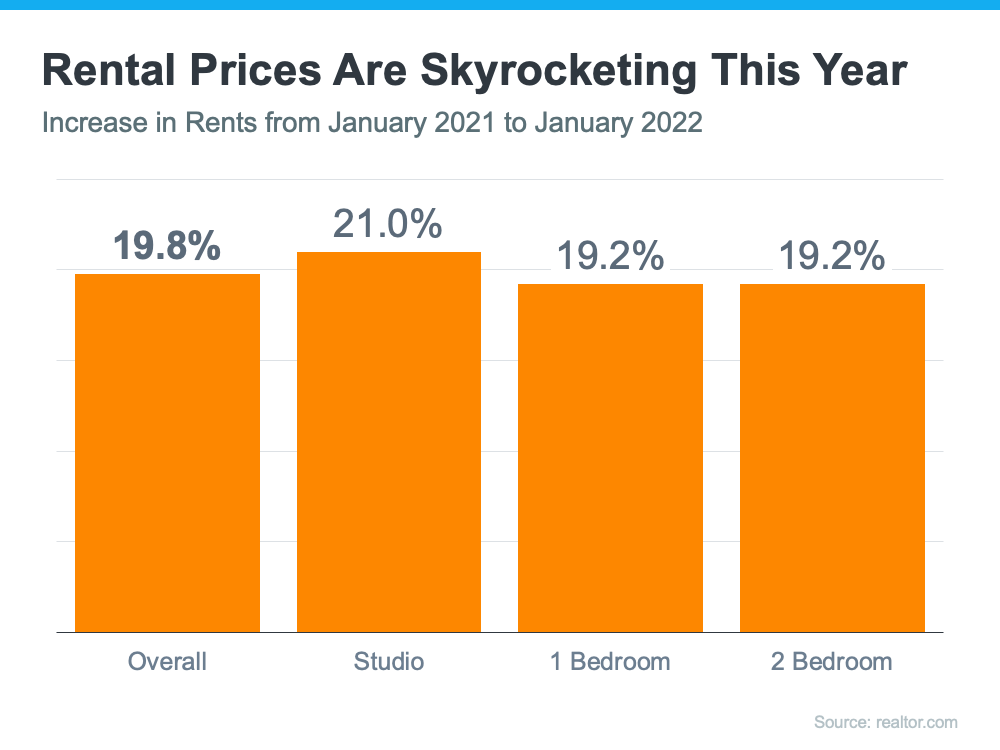

Rents Are Going Up Again This Year

Rents are skyrocketing right now. Data from realtor.com shows just how much rental prices are surging throughout the country. The graph below highlights rental unit price increases over the past year:

If you’re a renter and plan on signing a new lease, your monthly costs are likely to go up when you do. Those rising costs can have a big impact on your financial goals, including any plans you’re making to save for a home purchase.

Homeownership Offers Stable Monthly Costs

Of course, one of the key benefits of owning your home is that you’re able to lock in and stabilize your payments for the duration of your loan. That’s not the case when you rent.

While rents are already on the rise, there’s a good chance many people will see their rental costs increase even more this year. As Danielle Hale, Chief Economist at realtor.com, says:

“With rents already at a high and expected to keep going up, rental affordability will increasingly challenge many Americans in 2022. For those thinking about making the transition from renting to buying their first home, rising rents will remain a motivating factor. . . .”

So, if you’re ready to become a homeowner, waiting any longer may not make financial sense. Instead, escape the cycle of rising rents and enjoy the many benefits that come with homeownership today.

Bottom Line

Starting your journey towards homeownership can pay off significantly this year. If you’re financially ready today, let’s connect so we can discuss your options.

If you want to save money on your home loan, you might be thinking about refinancing your mortgage. You might be able to replace your existing mortgage with a home loan that has a lower interest rate. Even a single point reduction in your interest rates could save you tens of thousands of dollars over the life of your loan. Before you refinance, be sure to ask about closing costs. Because you are replacing your existing home loan with a new one, you may incur some closing expenses. On the other hand, you could also have negative closing costs. In this case, you might get paid to refinance. How does this work?

If you want to save money on your home loan, you might be thinking about refinancing your mortgage. You might be able to replace your existing mortgage with a home loan that has a lower interest rate. Even a single point reduction in your interest rates could save you tens of thousands of dollars over the life of your loan. Before you refinance, be sure to ask about closing costs. Because you are replacing your existing home loan with a new one, you may incur some closing expenses. On the other hand, you could also have negative closing costs. In this case, you might get paid to refinance. How does this work?