Are you considering buying your first home? If so, it can be helpful to know what led other people to make that decision. According to a recent survey of first-time homebuyers by PulteGroup:

“When asked why they purchased their first home recently, the answer was simple: because they wanted to. Either the desire to stop renting or recognition that homeownership is a smart financial investment was the main motivator for 72% of respondents.”

While that survey looked specifically at first-time homebuyers buying newly built homes, the same sentiment is true for just about anyone buying their first home. Here’s a bit more information to help you think about those two benefits of homeownership to see if they’re a key factor for you too.

When You Buy a Home, You Have More Stability than When You Rent

You might want to stop renting because rents keep going up. If you’re a renter, that means there’s a chance your payment will increase each time you sign a new rental agreement or renew your current one.

On the other hand, when you buy your home with a fixed-rate mortgage, your monthly housing payment is predictable over the length of that loan. This stability can give you a peace of mind that renting just can’t provide. Jeff Ostrowski, real estate journalist, breaks it down:

“With a fixed-rate mortgage, your monthly principal and interest payment is set for as long as you keep the loan. Sign a rental lease, however, and you could see your rent rise the following year, the year after that and so on.”

When You Buy a Home, You Grow Your Wealth as Home Values Climb

Beyond that, owning a home can also be a great long-term investment. While renting may be the more affordable option right now, it doesn’t provide an avenue for you to grow your wealth over time. Mark Fleming, Chief Economist at First American, explains that’s an important distinction to consider:

“Given current dynamics, more young households may choose to rent in the near term as the cost to own, excluding house price appreciation, has unequivocally increased. Yet, accounting for house price appreciation in that cost of homeownership, whether to rent or buy will depend on where, and if, a home is likely to cost more or less in the near future.”

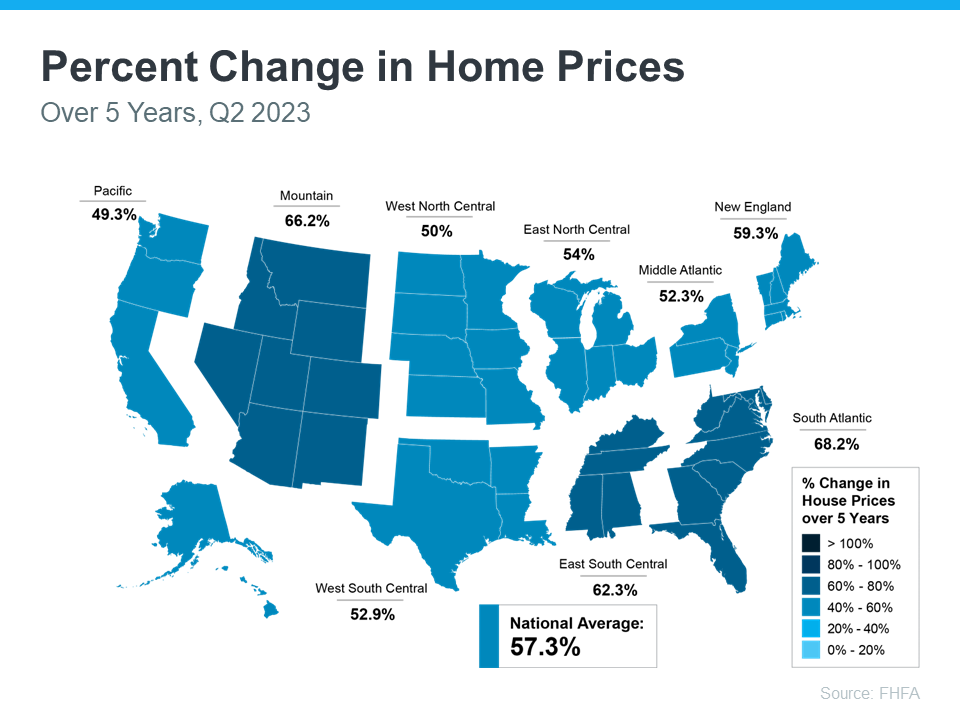

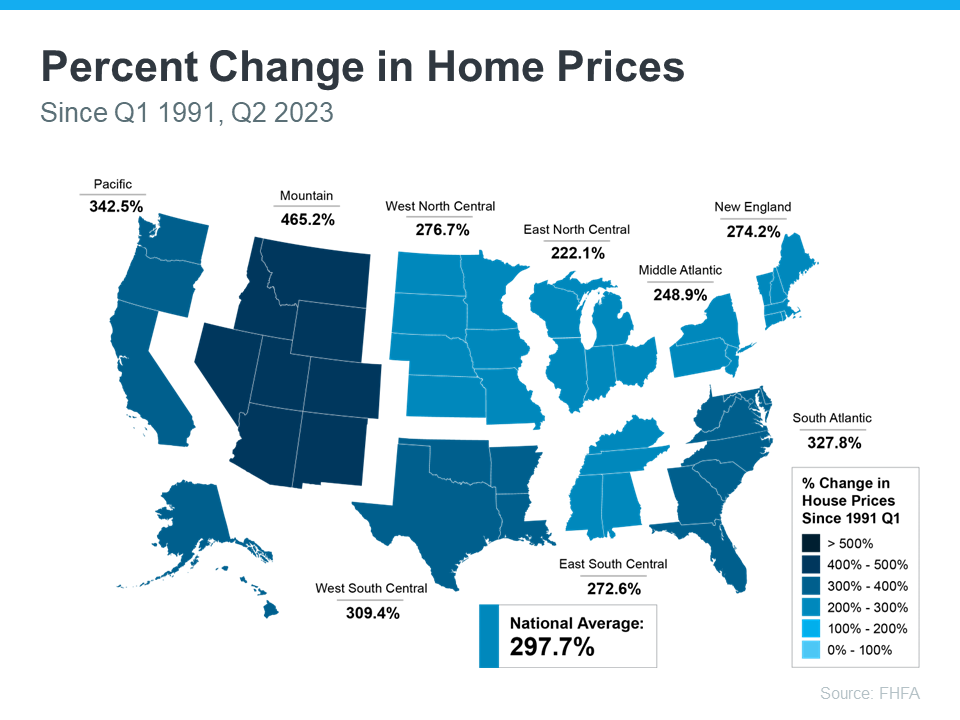

Basically, renting doesn’t allow you to build equity. In contrast, homeownership can help you grow your net worth as your home’s value appreciates. That’s a significant perk you can’t get if you keep renting.

When you take that into account, it may make better financial sense to buy. Most experts project home prices will continue to appreciate over the next few years at a pace that’s more normal for the market. That means when you buy a home, not only are you investing in a place to live, but you’re also investing in your financial future.

Bottom Line

If you’re ready, it can be a smart move to buy your first home instead of renting. Let’s connect so you can stabilize your housing payment and start building wealth for your future.

They say, “you never get a second chance to make a good impression”, and when it comes to your home, curb appeal is the key to making a lasting one. Enhancing the exterior of your house not only adds value but also creates a warm and inviting atmosphere for both you and your guests.

They say, “you never get a second chance to make a good impression”, and when it comes to your home, curb appeal is the key to making a lasting one. Enhancing the exterior of your house not only adds value but also creates a warm and inviting atmosphere for both you and your guests.