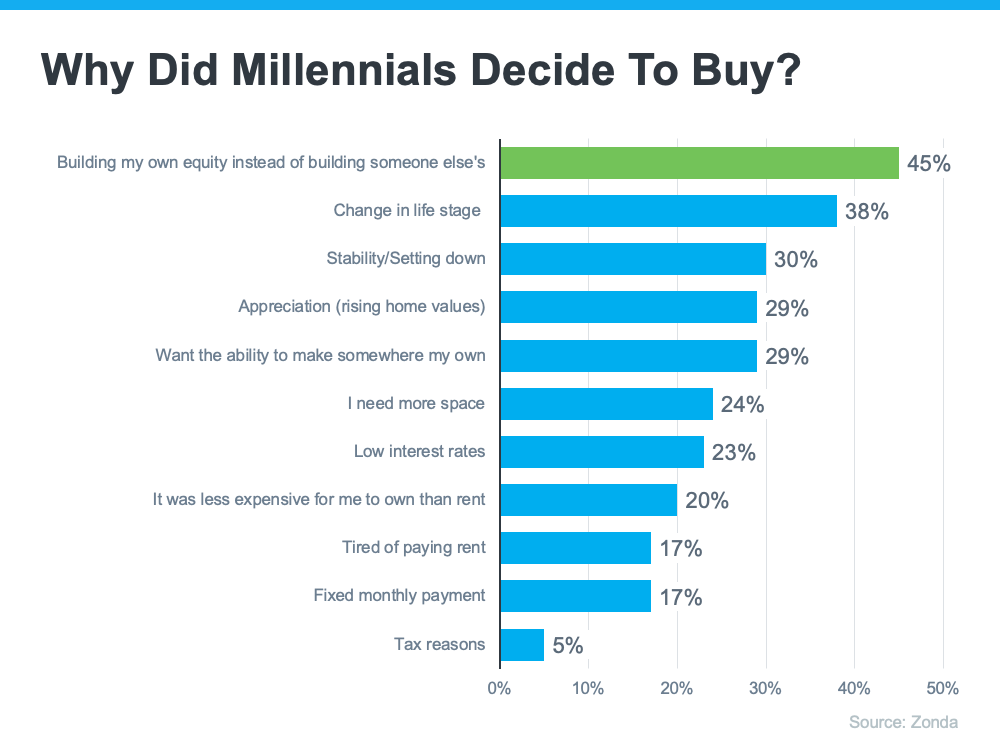

In the United States, there are over 72 million millennials. If you’re part of that generation and have thought about buying a home, you aren’t alone. According to Zonda, 98% of millennials want to become a homeowner at some point if they aren’t already. But why? There are plenty of reasons you may choose to become a homeowner. Here’s why other millennials have made that decision (see graph below):

This graph shows why millennials are buying homes according to Zonda’s 6th annual millennial survey. The top reasons include building equity, a change in life stage, wanting stability, rising home values, and wanting to make somewhere truly their own. Here’s a look at each in more detail.

Building equity – Homeownership is a long-term investment that allows you to build wealth, increase your net worth, and become more financially stable. Beyond that, the alternative to owning a home is typically renting. With the way rents have risen so dramatically over time, it may make sense to build your own equity instead of the equity of the person you’re renting from.

A change in life stage – As a millennial, you’re reaching your prime homebuying years. That means you may be at the point where you need more space or a different location.

Stability or settling down – This could mean establishing your career or just generally deciding more concretely what you want your life to look and feel like. As that idea becomes clearer, you may want to establish that lifestyle in a particular place and put down roots.

Rising home values – By purchasing a home, you own an asset that traditionally increases in value over time. That can mean your home will have a higher resale value if you decide to move again.

Wanting to make somewhere “mine” – Owning a home gives a sense of freedom because you can customize it however you want, make updates as you see fit, and be yourself in a place that’s solely your own.

Bottom Line

There are plenty of great reasons why millennials are buying homes today. If you’ve thought about becoming a homeowner and any of these reasons resonate with you too, let’s connect to explore your options.

Owning a home can be an exciting and rewarding experience, but it’s important to be aware of the expenses that come with homeownership. Understanding these costs can help you prepare for and manage them effectively, ensuring a smoother transition into your new home.

Owning a home can be an exciting and rewarding experience, but it’s important to be aware of the expenses that come with homeownership. Understanding these costs can help you prepare for and manage them effectively, ensuring a smoother transition into your new home.