Home buyers continue to push the U.S. housing market forward.

Home buyers continue to push the U.S. housing market forward.

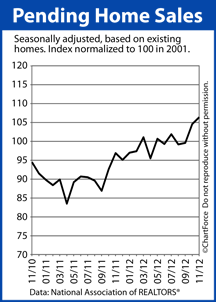

In November, for the second straight month, the Pending Home Sales Index eclipsed its benchmark reading of 100, posting a value of 106.4.

The Pending Home Sales Index (PHSI) is published monthly by the National Association of REALTORS®. It tracks homes under contract to sell, but not sold. The PHSI is relative index, comparing current contract activity to the activity of 2001 — the first year for which “pending homes” were tallied for an index.

The Pending Home Sales Index has posted an average score of 100.2 from January 2012 through November 2012, the most recent month for which there’s data. This is a significant data point because it means that the 2012 housing market is performing better than the 2001 housing market; one which is widely considered a strong one for housing.

It’s also meaningful because it foreshadows a strong market for 2013. With an increasing number of homes under contract to sell, it can be assumed that “closed units” will increase in the future, too.

The National Association of REALTORS® says that 80% of U.S. homes under contract go to closing within 60 days, and that many of the remaining homes go to closing within days 61-120.

The monthly Pending Home Sales Index, therefore, can foreshadow to today’s buyers and sellers what’s ahead for the housing market.

The Pending Home Sales Index is a forward-looking indicator.

Based on November Pending Home Sales Index, we should expect to the home resale market to remain strong, and to pick up strength, through the first quarter of 2013. Demand for homes is high, mortgage rates are low, and buyers are looking to get a good deal.

The first few months of the year are often thought to be “slow” for the housing market. This year, however, that may not be the situation. If you’re actively looking for homes in Minneapolis, the best prices may be the ones you get this winter. Click Minnesota Real Estate Today Properties

Mortgage rates moved higher Wednesday up congressional leaders voted to avoid the “Fiscal Cliff”.

Mortgage rates moved higher Wednesday up congressional leaders voted to avoid the “Fiscal Cliff”. Some natural disasters can be forecast — hurricanes, snow storms and, in some cases, flooding. Other disasters occur unexpectedly, such as tornadoes and earthquakes.

Some natural disasters can be forecast — hurricanes, snow storms and, in some cases, flooding. Other disasters occur unexpectedly, such as tornadoes and earthquakes.