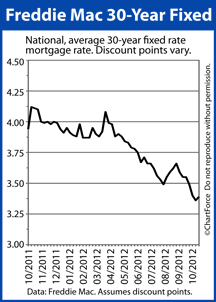

Mortgage rates in Minnesota continue to troll near all-time lows, boosting the purchasing power of home buyers statewide.

According to Freddie Mac’s most recent Primary Mortgage Market survey, the average 30-year fixed rate mortgage is now 3.39 percent nationwide, just three ticks off an all-time low. At the start of last quarter, 30-year fixed rate mortgage rates averaged 3.62 percent.

One year ago, they averaged 4.12%.

When mortgage rates are falling, they present Minneapolis home buyers with interesting options. Because of lower rates, buyers can choose to tighten their household budgets, buying an ideal home but paying less to own it each month. Or, for buyers who shop for homes by “monthly payment”, falling mortgage rates put more homes with affordability’s reach.

As a real-life example, for a buyer whose monthly principal + interest mortgage payment is limited to $1,000 per month, and whom opts for a 30-year fixed rate mortgage, as compared to January of this year, the maximum property purchase price has climbed 6.6%, or $14,000 in list price.

Consider this comparison:

- January 2012 : A payment of $1,000 afforded a maximum loan size of $211,756

- October 2012 : A payment of $1,000 affords a maximum loan size of $225,771

The 6.6 percent increase in affordability outpaces this year’s rise in home prices and is one reason why the U.S. housing market is improving. Slowly and steadily, the U.S. economy is improving and “good deals” in housing are becoming harder to find. In addition, because homeownership is now less expensive than renting in many U.S. cities, home demand among buyers continues to rise.

For today’s home buyer, market conditions appear ripe. Mortgage rates are near all-time lows, low-downpayment mortgage program remain plentiful, and home values have been rising since late-2011. Within 6 months, rates may be up and homes prices, too. Purchasing power would decline, decreasing home affordability nationwide.

The best “deals” in housing, therefore, may be the ones you find today. For Minnesota Real Estate Today

Mortgage markets improved slightly last week. With a dearth of new U.S. economic data due for release, investors turned their collective attention to the Europe, China, and the Middle East.

Mortgage markets improved slightly last week. With a dearth of new U.S. economic data due for release, investors turned their collective attention to the Europe, China, and the Middle East.