Mortgage markets improved for the second consecutive week last week as demand for U.S. mortgage-backed bonds remained high. A series of economic reports showed strength in housing and a stability in jobs.

Mortgage markets improved for the second consecutive week last week as demand for U.S. mortgage-backed bonds remained high. A series of economic reports showed strength in housing and a stability in jobs.

Wall Street looked past it, however, to send mortgage rates to their lowest levels in history.

One week into the Federal Reserve’s newest bond-buying program, the stimulus appears to be working.

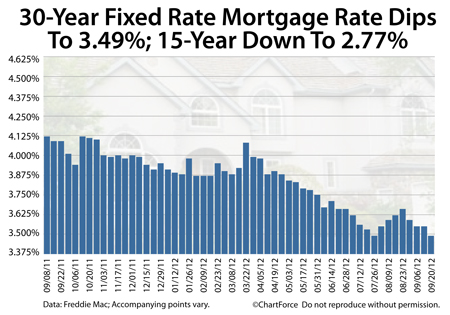

According to Freddie Mac, the average 30-year fixed rate mortgage rate slipped to 3.49% last week for borrowers willing to pay an accompanying 0.6 discount points at the time of closing. Discount points are a one-time closing costs where 1 discount point is equal to one percent of your loan size.

3.49% marks a new all-time low for the 30-year fixed rate mortgage.

The 15-year fixed rate mortgage rate fell to a new all-time low last week, too, dropping to 2.77% with the same accompanying 0.6 discount points.

Mortgage rates in Minnesota fell despite strong housing data.

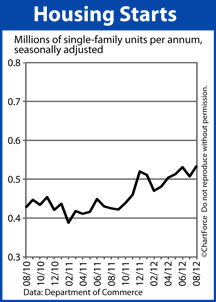

- Housing Starts rose 5.5% to a 2-year high

- Existing Home Sales rose 7.8% to a 2-year high

- Building Permits rose 0.2%

Notably, according to the National Association of REALTORS®, the national existing home supply slipped to 6.1 months last month — very close to the 6.0-month marker which separates a “buyer’s market” from a “seller’s market”.

If supplies continue lower, home prices may rise more quickly than expected into 2013. Median home sale prices are already 9.5% higher as compared to one year ago.

This week, more housing data is set for release including the home value-tracking Case-Shiller Index and FHFA Home Price Index. Both are expected to show rising home prices as compared to the last recorded month, and one year ago. In addition, the National Association of REALTORS® releases its Pending Home Sales Index.

Lastly, and likely most important to mortgage rates and home affordability in Minneapolis/St Paul , the government releases its Personal Consumption Expenditures (PCE) report Friday. PCE is the Federal Reserve’s preferred inflation gauge. An unexpected increase is expected to move mortgage rates higher.

The new construction housing market continues to make gains.

The new construction housing market continues to make gains.