How well do you conserve water?

How well do you conserve water?

The government’s EPA estimates that the average family of four uses 146,000 gallons of water per year, at a cost of $700. With just a few small changes, however, that cost could drop by as much as 28%.

You’ll save on more than just your water bill, too. You may save on Minneapolis/St Paul taxes.

This is because water management is often handled at the municipal level and as water usage grows, so does the need for costly investment in water treatment and delivery systems. Less usage means lower costs.

You’ll also enjoy lower home energy bills. 25 percent of a home’s energy bill is used to heating water for home use.

So, with the above three benefits in mind, here are three ways to cut your household water usage.

Catch Your Shower Water

Nobody likes to step into a cold shower, and we sometimes run our showers for 5 minutes before stepping in. Even with today’s low-flow shower heads, that’s 10 gallons of water wasted. Instead of allowing pre-shower water to run down the drain, catch it in a bucket, instead. Then use the bucket to water house plants and your garden.

Stop Pre-Rinsing Dishes

Today’s dishwashers are heavy-duty food busters. Don’t pre-rinse dishes in the sink, only to move them to the dishwasher where the job will be duplicated. Instead, use a wet sponge to wipe dishes clean, then place them in the dishwasher. The job will get done just as well. Or, for caked on foods, follow the steps above then start the dishwasher. After 3 minutes, pause the cycle to allow water to sit-and-soak on your dishes. Then, restart the cycle as normal.

Test Your Toilets

A single leaking toilet can spill 60 gallons of water per day and there are several places where leaks can occur. The toilet may have a worn out flapper; or, a damaged gasket under the flush valve; or, a crack in the overflow tube. One clear sign of a leak is having to jiggle the handle to make the toilet stop running. To test for leaks, try “the dye test”. Fill the toilet tank with food coloring or instant coffee to a deep color and wait 30 minutes. If any of the coloring finds it way to the toilet bowl, you know you have a leak.

In addition to the tips above, the EPA keeps a list of water-saving steps on its website. See how many steps you can take to reduce your home water usage.

(Image courtesy : EPA.gov)

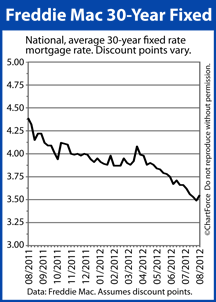

Mortgage rates couldn’t fall forever, it seems.

Mortgage rates couldn’t fall forever, it seems. The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday. The vote was nearly unanimous.

The Federal Open Market Committee voted to leave the Fed Funds Rate unchanged within its current target range of 0.000-0.250 percent Wednesday. The vote was nearly unanimous.