The housing market’s bottom is 9 months behind us. Home values continue to climb nationwide.

The housing market’s bottom is 9 months behind us. Home values continue to climb nationwide.

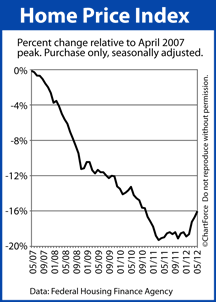

According to the Federal Home Finance Agency’s Home Price Index, home values rose 0.8% in May on a monthly, seasonally-adjusted basis. May’s reading marks the sixth time in seven months that home values rose.

Values are now higher by 4 percent since the market’s October 2011 bottom.

As a Minneapolis home buyer or seller, though, it’s important to understand what the Home Price Index measures. Or, more specifically, what the Home Price Index doesn’t measure.

Although widely-cited, the HPI remains widely-flawed, too. It should not be your sole source for real estate data.

As one example of how the Home Price Index is flawed, consider that the HPI only tracks the values of homes with an associated Fannie Mae- or Freddie Mac-backed mortgages. Homes with mortgages insured by the FHA are excluded, as are homes paid for with cash.

5 years ago, this wasn’t a big deal; the FHA insured just 4 percent of the housing market and cash sales were relatively small. Today, though, the FHA is estimated to insure more than 30% of new purchases and cash sales topped 17 percent in May 2012.

That’s a sizable subset of the U.S. housing market.

A second flaw in the Home Price Index is that it tracks home resales only and ignores new home sales. New home sales represent roughly 10% of the today’s housing market, so that’s a second sizable subset excluded from the HPI.

And, lastly, we can’t forget that the Home Price Index is on a 60-day publishing delay.

It’s nearly August, yet we’re only now receiving home valuation data from May. A lot can change in the housing market in 60 days, and it often does. The HPI is not reporting on today’s market conditions, in other words — it’s reporting on conditions as they existed two months ago. Information like that is of little use to today’s buyers and sellers.

For local, up-to-the-minute housing market data, skip the national data. Talk with a local real estate agent instead.

Since peaking in April 2007, the FHFA’s Home Price Index is off 16.0 percent.

Typically found at the tip of indoor water faucets, water aerators split a single water stream into droplets, slowing the overall water flow and reducing the degree of “splashing”.

Typically found at the tip of indoor water faucets, water aerators split a single water stream into droplets, slowing the overall water flow and reducing the degree of “splashing”.