America is stuffed with world-class “big cities”; New York, San Francisco and Chicago make for three great examples. But beyond the biggest cities, there are some wonderful small towns, too.

America is stuffed with world-class “big cities”; New York, San Francisco and Chicago make for three great examples. But beyond the biggest cities, there are some wonderful small towns, too.

Smithsonian.com highlights 20 of them on its website.

Focusing on cities with 25,000 residents or fewer, the publication ranked areas high in “culture”; towns with high concentrations of museums, public gardens, art galleries and other cultural assets including resident orchestras.

The author states “big cities and grand institutions per se don’t produce creative works; individuals do. And being reminded of that is fun”.

The Top 10 Small Towns in America, as judged by Smithsonian.com :

- Great Barrington, Massachusetts

- Taos, New Mexico

- Red Bank, New Jersey

- Mill Valley, California

- Gig Harbor, Washington

- Durango, Colorado

- Butler, Pennsylvania

- Marfa, Texas

- Naples, Florida

- Staunton, Virginia

Other notable cities on the list include Princeton, New Jersey; Beckley City, West Virginia; and Siloam Springs, Arkansas.

The Smithsonian.com website provides an in-depth review of each of its twenty listed cities, including historical notes and quotes from key community members. It makes for good reading by local residents and visitors, alike.

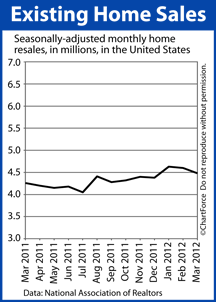

In March, for the second straight month, home resales slipped nationwide.

In March, for the second straight month, home resales slipped nationwide.